Tax: Business

Paley Rothman was originally founded by attorneys concentrating in taxation, and, as a result, our tax group has decades of experience in a wide range of tax matters impacting businesses, individuals and exempt organizations. Our practice handles matters related to corporate taxation, partnership taxation, corporate capital transactions, reorganizations, acquisitions, real estate, syndications, wealth taxation, pension and employee benefits, international taxation, tax-exempt organizations, state and local taxes as well as tax compliance and controversies. Paley Rothman’s tax attorneys regularly represent clients in tax matters before the Internal Revenue Service, the U.S. Tax Court, other federal courts and state taxing authorities.

The ever-changing nature of the tax code, the continuous release of administrative guidance and judicial interpretations requires that we continually monitor new developments. Our tax attorneys teach, lecture and publish on both a local and national level, and we are regularly called upon to analyze and submit comments on proposed legislative and regulatory changes to the tax code. We are actively involved in the tax sections of the American Bar Association and various state and local bar associations and one of our attorneys, Paul Marcotte, is a past Chair of the Maryland State Bar Association Section of Taxation.

Several of our tax attorneys have advanced degrees or training such as Master of Laws in Taxation or an MBA or have Certified Public Accounting credentials.

We advise business and individual clients on tax planning from a transaction’s inception such as negotiating the letter of intent through every stage of negotiation. Paley Rothman’s tax attorneys structure and negotiate mergers, acquisitions, reorganizations and sales of businesses.

At every point in a company’s development, we formulate business structures that capitalize on all available tax benefits. An entity’s initial formation as a corporation, LLC, partnership, joint venture, sole proprietorship is not the final step in this process. We believe that structuring must reflect the longer-term business plan or objectives of the owners/founders and in appropriate situations, succession related planning. The tax implications of profits or losses must be reviewed in light of the tax situations of the prospective business owners. Our attorneys also provide unique assistance in planning for venture syndication and for the offering of securities to investors and venture capital groups.

We handle all types of administrative proceedings with the Internal Revenue Service and state taxing authorities including through all levels of appeal. We also litigate tax cases when litigation appears to be the best way to resolve disputes. Many of our attorneys have prior government experience, affording them uniquely qualified perspectives and insights when evaluating the strengths and weaknesses of the government’s case.

Our tax attorneys are highly knowledgeable about complex federal, state and international reporting laws. We determine the appropriate reporting positions that should be taken by taxpayers, corporations, LLCs, partnerships, individuals, trusts, estates and other entities, working closely with our clients’ accountants and other professional advisors. We assist clients to remedy post compliance failures including non-filers with a view to minimizing penalties (both civil and criminal) including taking advantage, where appropriate, of voluntary disclosure programs (both domestic and offshore) offered by IRS and state taxing authorities.

Certain types of employee and executive benefits receive favorable income tax treatment. We have developed a deep understanding of the intricacies of various and unique benefit programs, including retirement plans, cafeteria plans, medical and disability benefit plans and deferred compensation plans. Our attorneys also design and advise employers and employees regarding short- and long-term executive compensation plans.

We help clients establish tax-exempt organizations and qualify them with the IRS. Our attorneys represent associations and are familiar with their unique challenges. We also help organizations obtain and maintain 501(c) status and work extensively with domestic and international foundations.

We advise a broad spectrum of clients on a variety of cross-border tax matters involving both inbound and outbound operations, activities and investments. We work with foreign based companies seeking to enter US markets on how to optimally structure their activities/operations in the US in the most tax efficient manner. We advise foreign investors seeking to acquire or expand real estate holdings in the U.S. as to strategies or structures that will minimize potential multiple layers of income tax on operating profits or to avoid undue exposure to wealth transfer taxes. We also work with U.S.-based companies seeking to expand operations abroad. In all cases, we highlight for clients where the U.S. has tax treaties with a foreign country that can minimize the potential for increased taxation in cross-border operations and investments.

We assist businesses and individual clients in navigating the increasingly complex tax regimes and compliance obligations imposed on U.S. persons with foreign assets, holdings or activities as well as advising such persons on strategies to remedy past compliance lapses where penalties are substantial. This type of work includes working with clients who have failed to file the so-called FBAR or foreign bank account report as well as who have not complied with expanded reporting obligations for foreign financial assets as a result of the enactment of FATCA. We work with such clients on related controversy matters and also more specialized matters such as expatriation and also pre-immigration planning for foreign persons seeking to come and live in the U.S.

News

March 21, 2023

Michelle Chapin’s Article on the Use of Arbitration Causes in Trusts is Published by the MSBA’s Estate & Trust Law Section

Michelle Chapin, a Principal in Paley Rothman’s Estate Planning department, authored an article titled "(Un)Enforceability of Arbitration Clauses in Maryland Trusts" in the MSBA's Estate & Trust Law Section Newsletter Volume 29 Issue 1.

Read MoreBlog

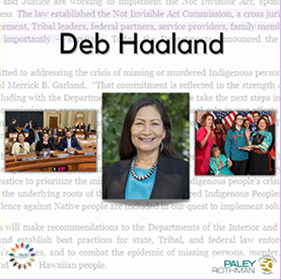

Sec. Deb Haaland – First Native American in the Cabinet

Sec. Deb Haaland is the first Native American to serve in the President’s cabinet and has been instrumental in bringing attention and action to the horrific incident rate of...

Read More