Employee Benefits

Paley Rothman’s employee benefits attorneys tailor innovative employee benefit plans to suit each client’s unique needs. We take pride in our client-specific plan designs; we do not rely on “canned plans” or external consultants to perform our services.

The employee benefits group designs and drafts various types of non-qualified deferred compensation plans for key employees of nonprofit and for profit organizations, including 457(b) plans, 457(f) plans, Rabbi trusts, stock appreciation rights plans, secular trusts, top-hat plans, incentive stock option plans, non-qualified stock option plans and phantom stock plans. As part of our comprehensive planning in executive compensation, we analyze and assist in the implementation of innovative insurance products that yield mutual benefits for our institutional clients and their key employees.

Paley Rothman’s employee benefits attorneys work closely with clients and third-party administrators to design and implement optimized cafeteria plans while enhancing employee understanding through targeted communications. We often reshape the standard turn-key operations offered by third parties to ensure that the benefits meet the goals of the employer and that the materials distributed to employees are clear and comply with the laws and regulations. Several of our attorneys are currently working to change the Internal Revenue Code so that cafeteria plans will be more beneficial to privately held businesses.

We provide ongoing legal advice on qualified retirement plans for companies of all sizes, including nonprofit and trade associations. Our attorneys have decades of experience with all types of qualified retirement plan designs, including sophisticated cross-tested plans, cash balance plans and defined benefit plans. The attorneys in Paley Rothman’s employee benefits group have written hundreds of 401(k) plans, including “safe harbor” 401(k) plans. Our retirement plans are written to give employers the freedom to select whatever investment platforms they desire. Therefore, our clients are not restricted to any particular brokerage house, as they would be if they adopted a brokerage house’s canned plan. This also gives our clients the freedom to change investment houses without having to change the plan document. Upon implementation of these plans, we continue to provide advice and prepare the documents necessary to ensure that they remain in compliance with IRS and DOL regulations.

Attorneys in the employee benefits group frequently lecture to national, regional and local associations as well as to continuing legal education groups, including the American Bar Association, ALI CLE and the Practising Law Institute. These programs augment our technical knowledge and keep us apprised of any developments in this fast-moving field so that we can better serve our clients.

Paley Rothman’s employee benefits attorneys closely follow the latest committee and legislative actions pending in Congress. Our attorneys are currently working on a major legislative initiative that would change the rules applicable to cafeteria plans so that the owners of small and privately held businesses can use these plans. Because legislation in the employee benefit area often takes effect immediately, we believe proper representation of our clients requires keeping a close eye on Congress. The chair of this group, Paula Calimafde, has testified on employee benefit issues before the House Committee on Ways and Means, the Senate Committee on Finance, and the Senate Small Business and Entrepreneurship Committee.

News

March 21, 2023

Michelle Chapin’s Article on the Use of Arbitration Causes in Trusts is Published by the MSBA’s Estate & Trust Law Section

Michelle Chapin, a Principal in Paley Rothman’s Estate Planning department, authored an article titled "(Un)Enforceability of Arbitration Clauses in Maryland Trusts" in the MSBA's Estate & Trust Law Section Newsletter Volume 29 Issue 1.

Read MoreBlog

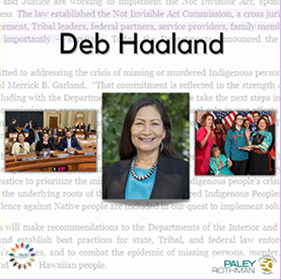

Sec. Deb Haaland – First Native American in the Cabinet

Sec. Deb Haaland is the first Native American to serve in the President’s cabinet and has been instrumental in bringing attention and action to the horrific incident rate of...

Read More